By Andrea Voigt, Area Manager Italy and PPA-Expert, aream Group

Global demand for electricity has fallen sharply due to the corona crisis. Even though private household consumption increased during the crisis, this does not compensate for the decline in industrial demand, which is almost twice as high. By contrast, demand for electricity from renewable energy sources has not fallen.

Representatives from politics and industry have recently stated that the "green policy" should be maintained. Before the crisis, more and more companies participated in green power projects, and even now environmental awareness has increased further. Negotiations on electricity supply contracts with companies (Corporate PPA) have stalled and will certainly need to be made more flexible in the future, but interest is still there.

In addition, the generation gap resulting from the imminent shutdown of nuclear power plants must be compensated. In the long term, considerable coal capacities will also go off the grid. The advancing sector coupling, i.e. the electrification of heat and transport, also leads to a higher demand for electricity from renewable energies.

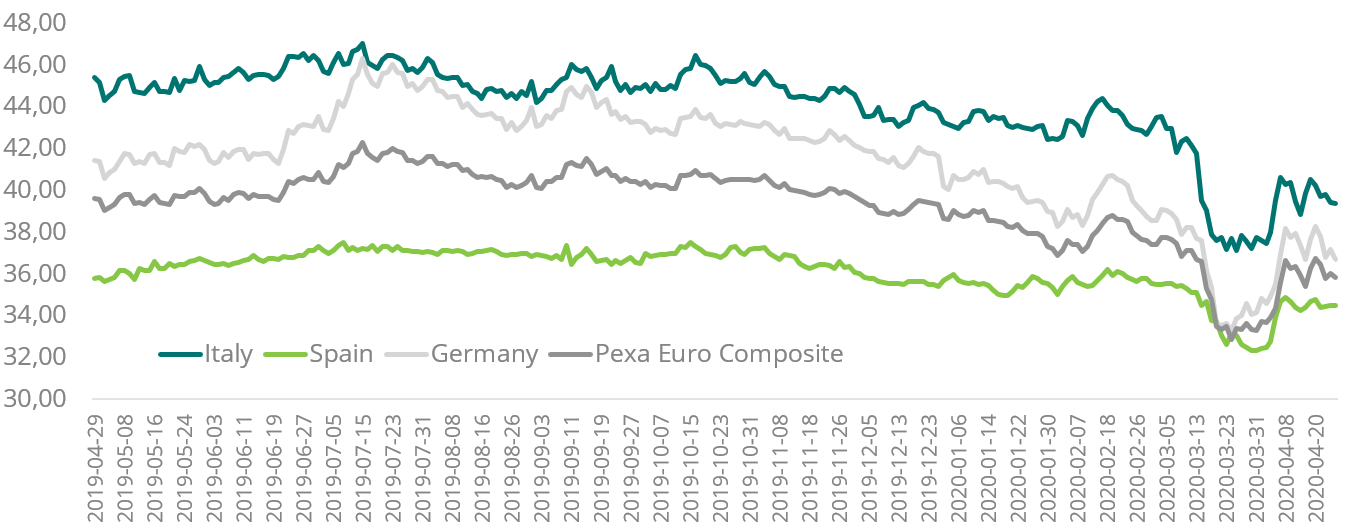

Electricity prices in Europe also fell sharply in mid-March due to the corona crisis, but rose again at the beginning of April, as can be clearly seen from the 10-year PPA prices. Major electricity traders expect electricity prices to rise and offer PPAs with prices that are almost the same as before the crisis.

Source: Pexapark: Entwicklung von zehn-Jahres Baseload PPA Preisen seit Juli 2019

Pexapark's indices reflect the new construction-weighted average of 10-year pay-as-produced PPA prices. The indices therefore mix wind and solar prices, i.e., they are not meant to be a reference for actual transaction prices, but rather average prices of the electricity volumes traded under PPAs.