Investments in the future.

Green Assets. invested smartly.

The energy industry is in flux, and Europe is playing a crucial role in the transformation process. Through falling technology costs and increased demand for renewable energies, clean energy has become a mature and permanent asset class. Solar and wind have now become the largest and most stable growth drivers.

SMART PERFORMANCE THROUGH STRONG PORTFOLIO APPROACH

Sun and wind yields often run contrary to each other, both throughout the year and over multiple years. So, it appears that both energy sources alternately generate high yields. To balance out these fluctuations, aream uses diversified portfolios with the focus on the two low correlating investment forms of sun and wind.

Through this diversification, we achieve a significantly more solid performance for our customers. Currently, the investment focus is on Europe and concentrating on investments in onshore wind power and photovoltaics. In the next few years, storage technologies will increasingly be included.

OUR Investment-UNIVERSE

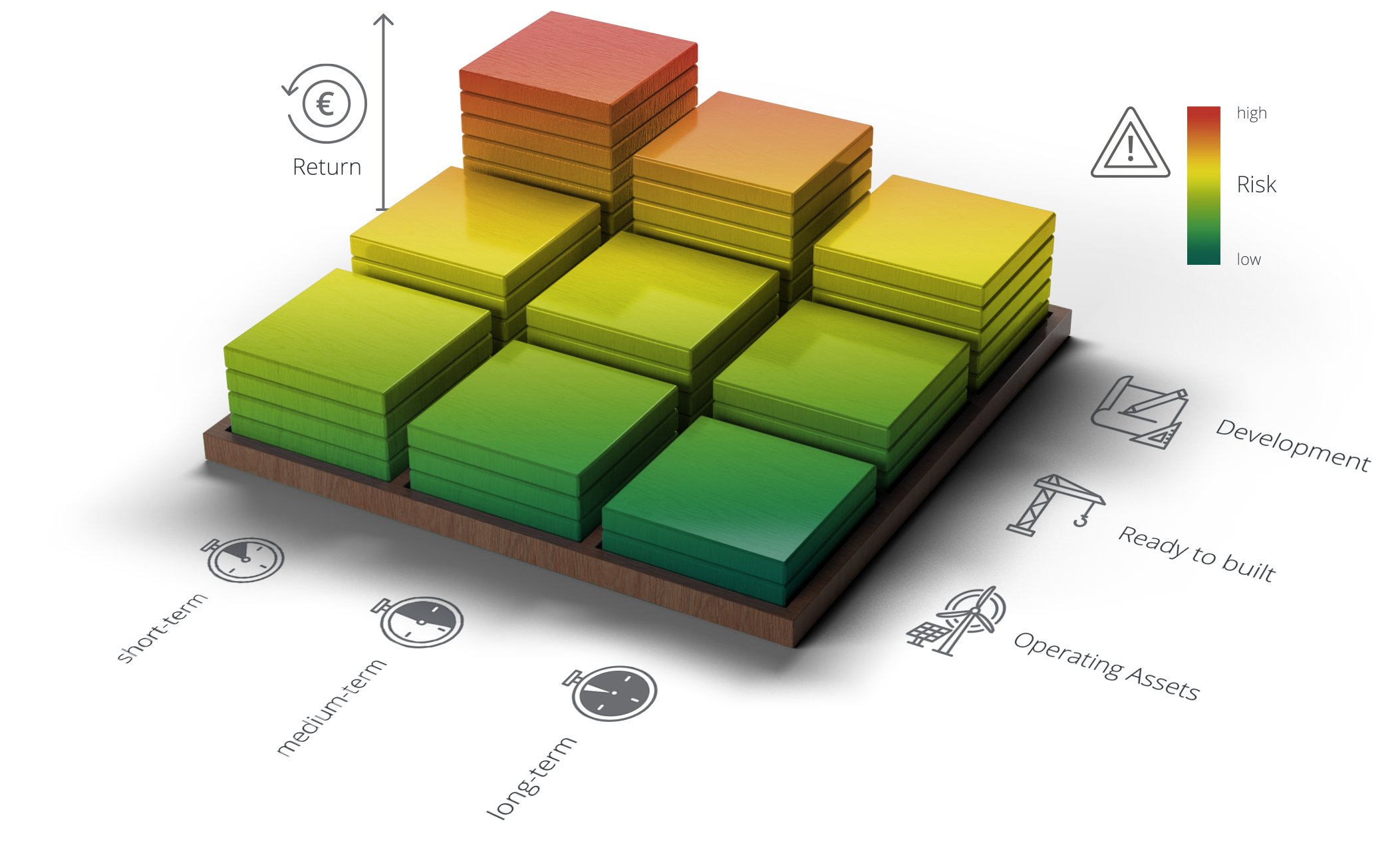

We implement a suitable investment strategy for the individual risk-opportunity profile of each type of investor.

From development risks with correspondingly high returns and short investment periods to long-term operator models for existing plants with correspondingly appropriate returns, any "intermediate form" can be implemented without any problems.

The Renewables Grown up

Due to the continual reduction of electricity generation costs, renewable energies have become competitive compared to traditional energy sources such as coal, gas and nuclear power. Apart from the expiring feed-in tariffs in Europe, direct power purchase agreements through end customers or power producers offer additional earnings potential.

In the next few years, an increasing number of renewable energy plants will reach the end of their funding period. Many of these plants will continue to operate without state funding and be available as a further attractive investment opportunity for direct marketing in the energy market.

The installed power in solar parks in EU member states is more than 126,000 MW. Additional installations of more than 20,000 MW per year are expected in the next few years, meaning that the photovoltaics market can expect a high number of transactions – both in existing parks and new building projects.

In doing so, the following applies: each project stands out due to different characteristics and the relevant market growth speeds depend strongly on the regulatory framework conditions. aream will advise you on selecting the right investments.

In the EU member states, more than 180,000 MW total capacity is installed in wind parks. Although additional installations are not advancing at the speed hoped for by the wind industry, the market is characterised by a multitude of transactions with existing parks and new projects. The regulatory framework conditions, optimum project size and concentration of ownership structures are therefore different in all states.

Private power purchase agreements are increasingly playing an important role in energy marketing, not only for new projects, but also for existing parks, as many funding programmes will expire in the next few years. With aream you can maintain an overview of the opportunities and risks.

The requirement for a sustainable energy supply is efficient storage technology. Sun and wind are of course very unstable by nature, and therefore not always available. That is why sun and wind energy must be used for power and heat generation through an integrated, energy efficient overall process.

There are already a multitude of energy storage technologies whose operating principles, associated storage volumes and performance vary greatly according to demand and area of use. aream identifies the most promising investment opportunities.